What Can I Write Off For My Home Office . What if your business has just one home office, but you do most of your work elsewhere? home office deduction at a glance. you can deduct the expenses related to your home office if your use is: Exclusive, • regular, • for your business, and. Direct expenses are 100% deductible, but most. Remember that the requirement is home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting.

from www.akounto.com

Direct expenses are 100% deductible, but most. Remember that the requirement is home office deduction at a glance. What if your business has just one home office, but you do most of your work elsewhere? home office expenses are direct or indirect for tax purposes. Exclusive, • regular, • for your business, and. you can deduct the expenses related to your home office if your use is: If you use part of your home exclusively and regularly for conducting.

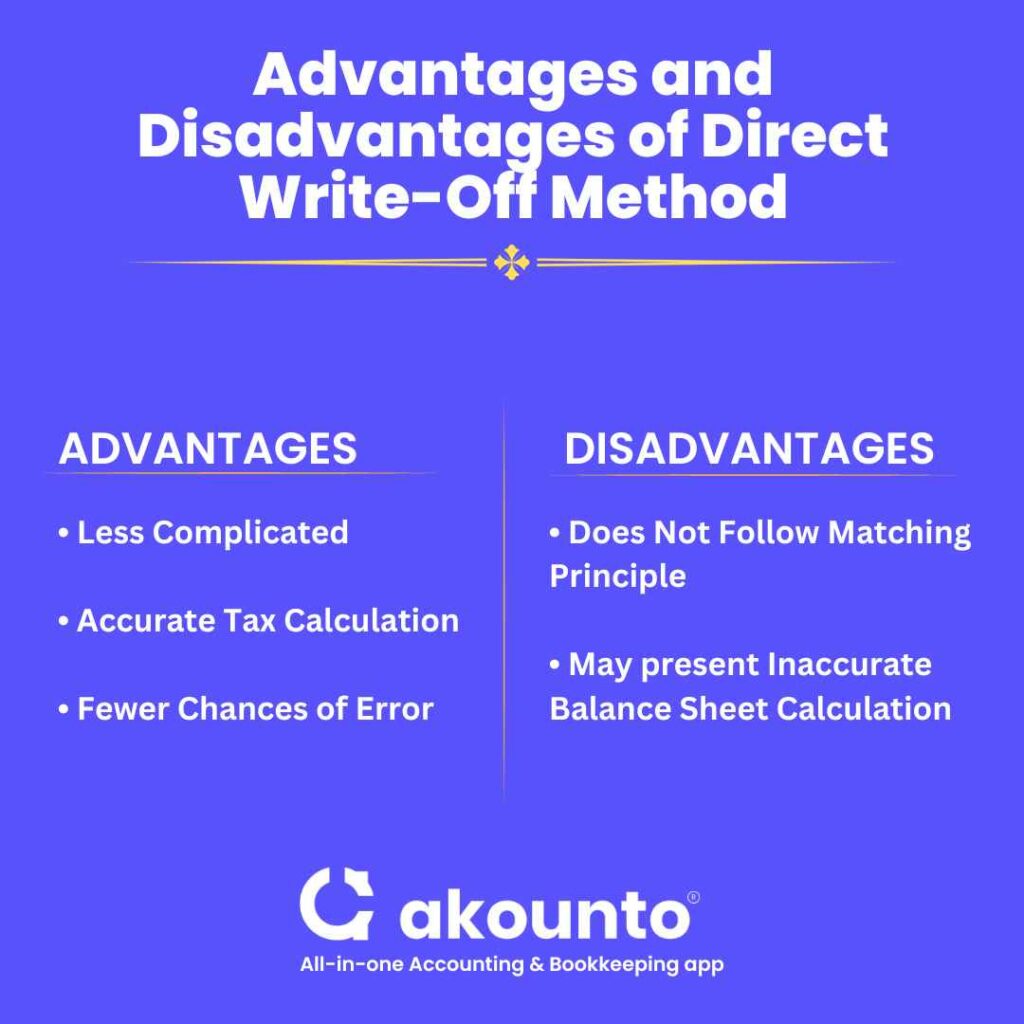

Direct WriteOff Method Definition & Examples Akounto

What Can I Write Off For My Home Office Exclusive, • regular, • for your business, and. Direct expenses are 100% deductible, but most. Remember that the requirement is you can deduct the expenses related to your home office if your use is: home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting. home office deduction at a glance. Exclusive, • regular, • for your business, and. What if your business has just one home office, but you do most of your work elsewhere?

From www.abc10.com

Can I write off home office expenses during the pandemic? What Can I Write Off For My Home Office Exclusive, • regular, • for your business, and. Direct expenses are 100% deductible, but most. home office deduction at a glance. What if your business has just one home office, but you do most of your work elsewhere? If you use part of your home exclusively and regularly for conducting. you can deduct the expenses related to your. What Can I Write Off For My Home Office.

From shunshelter.com

Home Office WriteOff What's The Deal? ShunShelter What Can I Write Off For My Home Office If you use part of your home exclusively and regularly for conducting. Remember that the requirement is What if your business has just one home office, but you do most of your work elsewhere? Direct expenses are 100% deductible, but most. home office deduction at a glance. you can deduct the expenses related to your home office if. What Can I Write Off For My Home Office.

From soundoracle.net

What Can You WriteOff on Your Taxes? SoundOracle Sound Kits What Can I Write Off For My Home Office Exclusive, • regular, • for your business, and. home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting. you can deduct the expenses related to your home office if your use is: What if your business has just one home office, but you do most of. What Can I Write Off For My Home Office.

From www.youtube.com

Can I Write Off Home Office Expenses in 2021? YouTube What Can I Write Off For My Home Office Remember that the requirement is If you use part of your home exclusively and regularly for conducting. Exclusive, • regular, • for your business, and. you can deduct the expenses related to your home office if your use is: home office deduction at a glance. What if your business has just one home office, but you do most. What Can I Write Off For My Home Office.

From hxepwgkgz.blob.core.windows.net

Can I Write Off Home.office at Whitney Migliore blog What Can I Write Off For My Home Office What if your business has just one home office, but you do most of your work elsewhere? Direct expenses are 100% deductible, but most. Remember that the requirement is Exclusive, • regular, • for your business, and. you can deduct the expenses related to your home office if your use is: home office deduction at a glance. . What Can I Write Off For My Home Office.

From homeofficeideas.netlify.app

Home Office Ideas What Can I Write Off For My Home Office Remember that the requirement is Direct expenses are 100% deductible, but most. you can deduct the expenses related to your home office if your use is: home office expenses are direct or indirect for tax purposes. home office deduction at a glance. What if your business has just one home office, but you do most of your. What Can I Write Off For My Home Office.

From www.youtube.com

Can You Write Off Home Improvements On Your Taxes? What Can I Write Off For My Home Office you can deduct the expenses related to your home office if your use is: Direct expenses are 100% deductible, but most. What if your business has just one home office, but you do most of your work elsewhere? Exclusive, • regular, • for your business, and. home office deduction at a glance. Remember that the requirement is . What Can I Write Off For My Home Office.

From exovoqnjn.blob.core.windows.net

Home Office Tax Write Off 2021 at Bell blog What Can I Write Off For My Home Office Remember that the requirement is What if your business has just one home office, but you do most of your work elsewhere? Direct expenses are 100% deductible, but most. you can deduct the expenses related to your home office if your use is: home office expenses are direct or indirect for tax purposes. home office deduction at. What Can I Write Off For My Home Office.

From tameereg.com

Write off your apartment What Can I Write Off For My Home Office you can deduct the expenses related to your home office if your use is: Exclusive, • regular, • for your business, and. home office expenses are direct or indirect for tax purposes. What if your business has just one home office, but you do most of your work elsewhere? If you use part of your home exclusively and. What Can I Write Off For My Home Office.

From shunshelter.com

Home Office WriteOffs What's Allowed? ShunShelter What Can I Write Off For My Home Office Direct expenses are 100% deductible, but most. Remember that the requirement is home office deduction at a glance. If you use part of your home exclusively and regularly for conducting. Exclusive, • regular, • for your business, and. home office expenses are direct or indirect for tax purposes. you can deduct the expenses related to your home. What Can I Write Off For My Home Office.

From www.cbs8.com

Can I write off home office expenses during the pandemic? What Can I Write Off For My Home Office home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting. you can deduct the expenses related to your home office if your use is: Remember that the requirement is Direct expenses are 100% deductible, but most. home office deduction at a glance. Exclusive, • regular,. What Can I Write Off For My Home Office.

From www.youtube.com

Ask NCH How Can I Write Off My Home Office? YouTube What Can I Write Off For My Home Office Exclusive, • regular, • for your business, and. What if your business has just one home office, but you do most of your work elsewhere? home office deduction at a glance. home office expenses are direct or indirect for tax purposes. you can deduct the expenses related to your home office if your use is: Direct expenses. What Can I Write Off For My Home Office.

From imanotalone.blogspot.com

What Can I Write Off If I Am 1099 Ethel Hernandez's Templates What Can I Write Off For My Home Office If you use part of your home exclusively and regularly for conducting. What if your business has just one home office, but you do most of your work elsewhere? Remember that the requirement is Exclusive, • regular, • for your business, and. home office deduction at a glance. you can deduct the expenses related to your home office. What Can I Write Off For My Home Office.

From mage02.technogym.com

Tax Write Off Template What Can I Write Off For My Home Office you can deduct the expenses related to your home office if your use is: What if your business has just one home office, but you do most of your work elsewhere? home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting. home office deduction at. What Can I Write Off For My Home Office.

From fabalabse.com

What can you deduct for home office 2023? Leia aqui What qualifies as What Can I Write Off For My Home Office home office deduction at a glance. What if your business has just one home office, but you do most of your work elsewhere? Remember that the requirement is you can deduct the expenses related to your home office if your use is: Direct expenses are 100% deductible, but most. Exclusive, • regular, • for your business, and. If. What Can I Write Off For My Home Office.

From www.appypie.com

How to Write a Memo with Memo Examples Templates & Format What Can I Write Off For My Home Office If you use part of your home exclusively and regularly for conducting. home office deduction at a glance. Direct expenses are 100% deductible, but most. Remember that the requirement is you can deduct the expenses related to your home office if your use is: What if your business has just one home office, but you do most of. What Can I Write Off For My Home Office.

From hxerlfeij.blob.core.windows.net

How Can I Write Off My Home Office at Rose Eastwood blog What Can I Write Off For My Home Office What if your business has just one home office, but you do most of your work elsewhere? home office deduction at a glance. you can deduct the expenses related to your home office if your use is: Remember that the requirement is home office expenses are direct or indirect for tax purposes. Exclusive, • regular, • for. What Can I Write Off For My Home Office.

From fabalabse.com

Can I write off home improvements on my taxes? Leia aqui How much of What Can I Write Off For My Home Office If you use part of your home exclusively and regularly for conducting. you can deduct the expenses related to your home office if your use is: home office expenses are direct or indirect for tax purposes. What if your business has just one home office, but you do most of your work elsewhere? home office deduction at. What Can I Write Off For My Home Office.